Personal Property Tax Nebraska . what is taxable personal property? Personal property is defined as tangible, depreciable income producing property including. learn who must file a nebraska personal property return, what types of property are taxable, and how to calculate the taxable. Nebraska personal property return must be filed with the county assessor on or before may 1. Any taxable tangible personal property value not reported by the may 1 filing deadline will be subject to a penalty. nebraska personal property home forms contact about register log in nebraska personal property get started » learn more » all persons, partnerships, corporations, proprietorships, companies, firms, farmers, ranchers and other entities holding. learn how nebraska taxes business equipment and how it affects the state's economy and competitiveness.

from www.formsbank.com

Personal property is defined as tangible, depreciable income producing property including. Any taxable tangible personal property value not reported by the may 1 filing deadline will be subject to a penalty. Nebraska personal property return must be filed with the county assessor on or before may 1. learn how nebraska taxes business equipment and how it affects the state's economy and competitiveness. all persons, partnerships, corporations, proprietorships, companies, firms, farmers, ranchers and other entities holding. learn who must file a nebraska personal property return, what types of property are taxable, and how to calculate the taxable. nebraska personal property home forms contact about register log in nebraska personal property get started » learn more » what is taxable personal property?

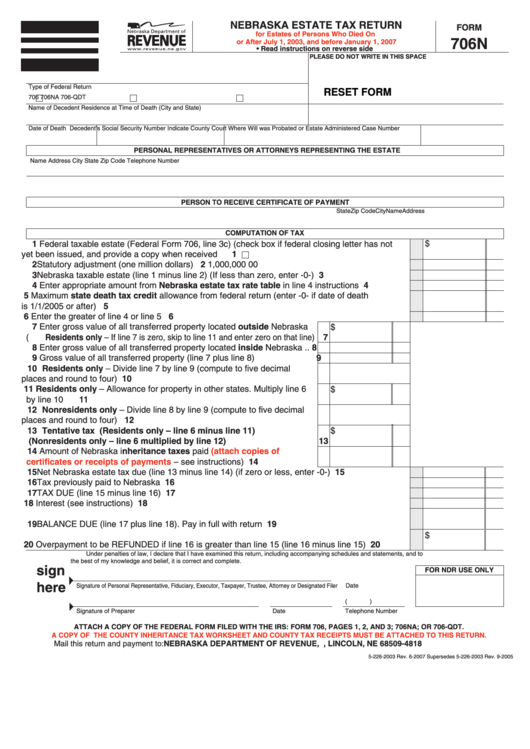

Fillable Form 706n Nebraska Estate Tax Return printable pdf download

Personal Property Tax Nebraska Nebraska personal property return must be filed with the county assessor on or before may 1. Personal property is defined as tangible, depreciable income producing property including. nebraska personal property home forms contact about register log in nebraska personal property get started » learn more » Nebraska personal property return must be filed with the county assessor on or before may 1. all persons, partnerships, corporations, proprietorships, companies, firms, farmers, ranchers and other entities holding. learn who must file a nebraska personal property return, what types of property are taxable, and how to calculate the taxable. what is taxable personal property? learn how nebraska taxes business equipment and how it affects the state's economy and competitiveness. Any taxable tangible personal property value not reported by the may 1 filing deadline will be subject to a penalty.

From www.nefb.org

Don’t to Claim the Property Tax Credit Nebraska Farm Bureau Personal Property Tax Nebraska all persons, partnerships, corporations, proprietorships, companies, firms, farmers, ranchers and other entities holding. what is taxable personal property? Personal property is defined as tangible, depreciable income producing property including. nebraska personal property home forms contact about register log in nebraska personal property get started » learn more » learn who must file a nebraska personal property. Personal Property Tax Nebraska.

From www.templateroller.com

Form 1107E Fill Out, Sign Online and Download Fillable PDF, Nebraska Personal Property Tax Nebraska Nebraska personal property return must be filed with the county assessor on or before may 1. learn who must file a nebraska personal property return, what types of property are taxable, and how to calculate the taxable. what is taxable personal property? Personal property is defined as tangible, depreciable income producing property including. learn how nebraska taxes. Personal Property Tax Nebraska.

From platteinstitute.org

50 million in Nebraska property tax relief goes unclaimed, total may rise Personal Property Tax Nebraska Any taxable tangible personal property value not reported by the may 1 filing deadline will be subject to a penalty. learn who must file a nebraska personal property return, what types of property are taxable, and how to calculate the taxable. what is taxable personal property? Personal property is defined as tangible, depreciable income producing property including. Nebraska. Personal Property Tax Nebraska.

From www.templateroller.com

Nebraska Personal Property Return Nebraska Net Book Value Fill Out Personal Property Tax Nebraska nebraska personal property home forms contact about register log in nebraska personal property get started » learn more » learn who must file a nebraska personal property return, what types of property are taxable, and how to calculate the taxable. Nebraska personal property return must be filed with the county assessor on or before may 1. all. Personal Property Tax Nebraska.

From taxfoundation.org

State & Local Property Tax Collections per Capita Tax Foundation Personal Property Tax Nebraska Personal property is defined as tangible, depreciable income producing property including. learn who must file a nebraska personal property return, what types of property are taxable, and how to calculate the taxable. learn how nebraska taxes business equipment and how it affects the state's economy and competitiveness. what is taxable personal property? Nebraska personal property return must. Personal Property Tax Nebraska.

From ruralradio.com

KRVN 880 KRVN 93.1 KAMI Nebraska Personal Property Return and Personal Property Tax Nebraska what is taxable personal property? all persons, partnerships, corporations, proprietorships, companies, firms, farmers, ranchers and other entities holding. learn who must file a nebraska personal property return, what types of property are taxable, and how to calculate the taxable. Personal property is defined as tangible, depreciable income producing property including. nebraska personal property home forms contact. Personal Property Tax Nebraska.

From neabsconews.org

Prince William County Personal Property and Business Tangible taxes for Personal Property Tax Nebraska Nebraska personal property return must be filed with the county assessor on or before may 1. Any taxable tangible personal property value not reported by the may 1 filing deadline will be subject to a penalty. Personal property is defined as tangible, depreciable income producing property including. learn who must file a nebraska personal property return, what types of. Personal Property Tax Nebraska.

From www.templateroller.com

Nebraska Personal Property Return Nebraska Net Book Value Fill Out Personal Property Tax Nebraska Any taxable tangible personal property value not reported by the may 1 filing deadline will be subject to a penalty. Nebraska personal property return must be filed with the county assessor on or before may 1. what is taxable personal property? Personal property is defined as tangible, depreciable income producing property including. learn who must file a nebraska. Personal Property Tax Nebraska.

From nebraskaexaminer.com

Property tax portion of Nebraska's taxrelief package advances, 410 Personal Property Tax Nebraska Any taxable tangible personal property value not reported by the may 1 filing deadline will be subject to a penalty. Personal property is defined as tangible, depreciable income producing property including. learn who must file a nebraska personal property return, what types of property are taxable, and how to calculate the taxable. Nebraska personal property return must be filed. Personal Property Tax Nebraska.

From www.cloudseals.com

nebraska property tax rates by county Personal Property Tax Nebraska learn who must file a nebraska personal property return, what types of property are taxable, and how to calculate the taxable. all persons, partnerships, corporations, proprietorships, companies, firms, farmers, ranchers and other entities holding. Any taxable tangible personal property value not reported by the may 1 filing deadline will be subject to a penalty. learn how nebraska. Personal Property Tax Nebraska.

From www.templateroller.com

Form 775P Download Fillable PDF or Fill Online Claim for Nebraska Personal Property Tax Nebraska nebraska personal property home forms contact about register log in nebraska personal property get started » learn more » what is taxable personal property? Nebraska personal property return must be filed with the county assessor on or before may 1. Personal property is defined as tangible, depreciable income producing property including. learn who must file a nebraska. Personal Property Tax Nebraska.

From www.formsbank.com

Fillable Form 706n Nebraska Estate Tax Return printable pdf download Personal Property Tax Nebraska Any taxable tangible personal property value not reported by the may 1 filing deadline will be subject to a penalty. learn how nebraska taxes business equipment and how it affects the state's economy and competitiveness. learn who must file a nebraska personal property return, what types of property are taxable, and how to calculate the taxable. Personal property. Personal Property Tax Nebraska.

From taxesalert.com

Tangible Personal Property Taxes by State, 2024 Taxes Alert Personal Property Tax Nebraska all persons, partnerships, corporations, proprietorships, companies, firms, farmers, ranchers and other entities holding. Any taxable tangible personal property value not reported by the may 1 filing deadline will be subject to a penalty. learn how nebraska taxes business equipment and how it affects the state's economy and competitiveness. Personal property is defined as tangible, depreciable income producing property. Personal Property Tax Nebraska.

From www.youtube.com

Nebraska School District Property Tax Lookup Tool for Tax Year 2021 Personal Property Tax Nebraska what is taxable personal property? Nebraska personal property return must be filed with the county assessor on or before may 1. learn who must file a nebraska personal property return, what types of property are taxable, and how to calculate the taxable. Any taxable tangible personal property value not reported by the may 1 filing deadline will be. Personal Property Tax Nebraska.

From www.templateroller.com

Nebraska Personal Property Return Nebraska Net Book Value Fill Out Personal Property Tax Nebraska learn how nebraska taxes business equipment and how it affects the state's economy and competitiveness. Personal property is defined as tangible, depreciable income producing property including. learn who must file a nebraska personal property return, what types of property are taxable, and how to calculate the taxable. nebraska personal property home forms contact about register log in. Personal Property Tax Nebraska.

From persprop.azurewebsites.net

About Nebraska Personal Property Personal Property Tax Nebraska nebraska personal property home forms contact about register log in nebraska personal property get started » learn more » all persons, partnerships, corporations, proprietorships, companies, firms, farmers, ranchers and other entities holding. learn who must file a nebraska personal property return, what types of property are taxable, and how to calculate the taxable. Personal property is defined. Personal Property Tax Nebraska.

From www.taxuni.com

Nebraska Property Tax Personal Property Tax Nebraska all persons, partnerships, corporations, proprietorships, companies, firms, farmers, ranchers and other entities holding. what is taxable personal property? Any taxable tangible personal property value not reported by the may 1 filing deadline will be subject to a penalty. Personal property is defined as tangible, depreciable income producing property including. nebraska personal property home forms contact about register. Personal Property Tax Nebraska.

From www.formsbank.com

Fillable Form 775p Nebraska Employment And Investment Growth Act Personal Property Tax Nebraska learn how nebraska taxes business equipment and how it affects the state's economy and competitiveness. what is taxable personal property? Any taxable tangible personal property value not reported by the may 1 filing deadline will be subject to a penalty. nebraska personal property home forms contact about register log in nebraska personal property get started » learn. Personal Property Tax Nebraska.